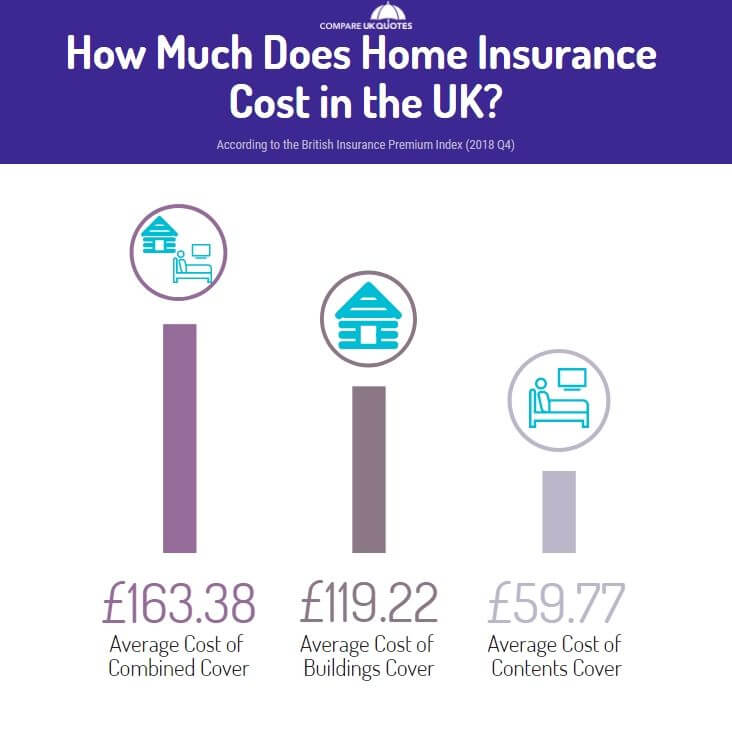

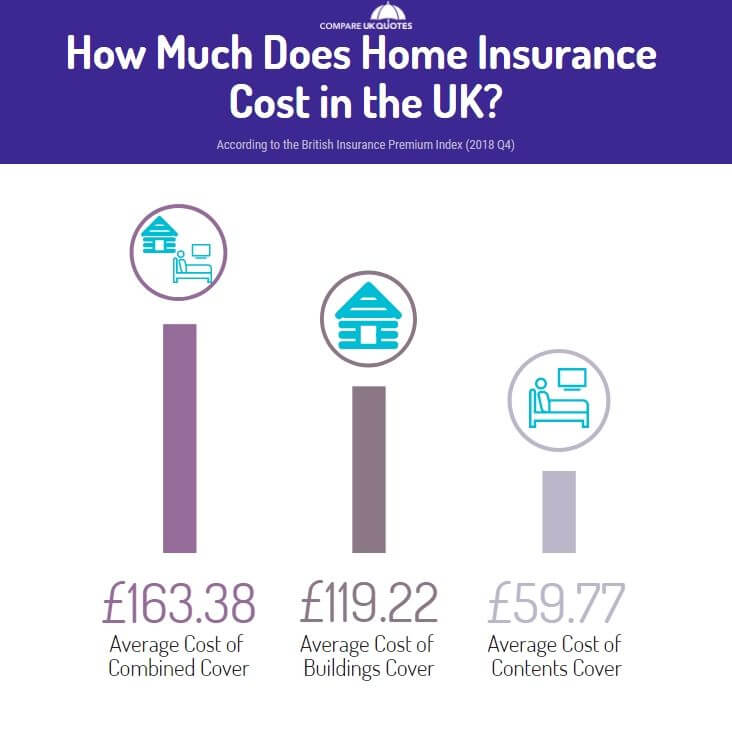

Choosing a higher deductible will reduce your car insurance coverage premium. That's since the insurance provider will pay out less if you file a vehicle insurance claim. It likewise indicates you'll pay more if you require to make a claim that has a deductible. Select a deductible quantity you're comfy with. Think of car insurance as spending for your protection from danger. Ariana Gibson, Head of Driver Insights at Clearcover If you have an older automobile, you may wish to drop protection like accident and detailed insurance. How much is home insurance. Nationally, the typical expense of accident insurance is $342 annually and the typical cost of detailed insurance is $153, according to the National Association of Insurance Commissioners.

The maximum insurance coverage payout you can get is the worth of your automobile if it's totaled. For instance, if your automobile deserves $2,000 and you have a $1,000 deductible, the maximum insurance coverage declares payment is $1,000. Keep in mind, if you have a vehicle loan or lease, the lending institution or renting company usually needs crash and thorough insurance. Even if you're not required to bring these coverage types, Great site it's a great concept to ask yourself if you could pay for to pay out-of-pocket to fix your vehicle or purchase a brand-new one if your current automobile is amounted to. If you can't, it's most likely better to keep these coverage types instead of regretting it later on.

Suspending automobile insurance is an action typically scheduled for situations in which you will not be using your cars and truck at all. An example may be a snowbird who resides in Florida for the winter season and the Northeast in the summer season. Another example is somebody who leaves on military deployment. In these circumstances, they may wish to suspend collision and liability protection, since they wouldn't be driving the vehicle, but keep thorough coverage in case of fire, flooding, vandalism or theft. A stay-at-home order is various - How to get health insurance. Your cars and truck is more than likely with you, suggesting you have access to it. You might even decide to drive it to the shop or doctor.

If your vehicle insurance provider does allow you to suspend coverage, reconsider. If you suspend your crash coverage or lower your liability automobile insurance coverage to just the state-required minimum, you could expose yourself to costly expenditures like automobile repair work bills or medical expenses if you injure somebody in a vehicle mishap. You need to only suspend protection in uncommon situations. And mishaps can take place even if you're not driving, like a hit-and-run mishap while your cars and truck is parked, falling tree branches and vehicle theft. Canceling automobile insurance should be a last resort. If you drive your car without insurance coverage, not just could you be accountable for property damage and medical costs, you could also deal with fines and prison time for driving uninsured.

You will not have any coverage if something happens while your car beings in the driveway, like fire, vandalism or theft. And you'll have a "coverage space," which insurers view as a greater threat. You'll pay greater rates Make certain you understand the policy's rules for taking out cash value and all of the monetary ramifications that feature that decision. You might make a tax-free withdrawal from your policy. Nevertheless, if you withdraw more cash worth than the portion moneyed by your premium payments, the investment gains you take are taxed as income. Also, getting money value will minimize your survivor benefit and your recipients will get less. Typically you can borrow tax-free from the money value of your policy. If you die before the loan and interest are paid back, the outstanding balance will be deducted from your survivor benefit.

You'll receive the cash value minus any surrender charge. Numerous sellers of universal life insurance usage "full underwriting," meaning they take some time to completely analyze your application, validate information, and need that you do a life insurance coverage medical exam. The medical examination typically includes height, weight, blood pressure, and blood and urine samples. It's typically done by a paramedical professional hired by the insurance coverage business, and can be done in your home. There's timeshare foreclosure laws a wide array of data about you available to insurance companies, who can utilize it in prices policies. How much is car insurance. This consists of data on customer credit, your prescription drug history, your answers on past private health and life applications, and your automobile record.

If you desire life insurance protection that lasts the period of your life, you may think about a universal life insurance coverage policy. For instance, universal life insurance can money a trust to look after a special needs child or other dependents after you're gone. You may also think about a universal life insurance policy if you have big long-term savings objectives and require both a financial investment https://rafaelhvdv876.mozello.com/blog/params/post/3306424/how-much-does-homeowners-insurance-cost-things-to-know-before-you-get-this car and life insurance coverage, but just after you've made the most of other cost savings options such as retirement strategies. See our rankings to find the best life insurance companies. Universal life isn't the ideal option for everybody's scenario.

Like universal life insurance coverage, whole life insurance coverage offers you coverage throughout of your life. It also consists of a cash worth part. The biggest distinction between entire life insurance coverage and universal life insurance coverage is the cost: Entire life insurance coverage is usually the most pricey method to buy permanent life insurance coverage since of the warranties within the policy: premiums are guaranteed not to change, the survivor benefit is ensured and money value has a minimum surefire rate of return - How much does health insurance cost. Also, indexed and variable universal life can provide you versatility with payments and the death benefit quantity after you buy the policy.

Entire life insurance coverage is suitable for somebody who likes predictability and wants to spend for it. In addition, lots of entire life insurance coverage policies pay dividends. These are like annual bonus offers paid by mutual insurance companies to consumers, although not ensured. You can utilize dividends to pay premiums, add it to your cash value or merely take the money. Term life insurance coverage is usually readily available for 5, 10, 15, 20, 25 or thirty years. It does not have a cash worth component and you could outlast the policy. But it's the cheapest wesley dale morgan way to buy life insurance coverage. For instance, you might purchase a 20-year policy to cover kids's growing years and college time.

About How Much Is Dental Insurance

If you outlive the term life policy it ends. There's no money worth to take away. That's why it's excellent to match your term life policy as best you can to the length of time you'll require protection. Compare Policies With 8 Leading Insurers The essential difference between whole life insurance and universal life insurance coverage is that universal life insurance can have more versatility. You can frequently vary your premium payments and death benefit with universal life. Entire life insurance coverage has set superior payments. However both kinds of policies have cash worth, and you can add riders to either one.

But prior to you take the cash value and run, make sure you will not require life insurance coverage in the future. Life's circumstances can change, and you don't want to regret cashing out a policy. If you require money now, consider taking a loan versus the policy instead of cashing it out. That gives you alternatives in the future, including keeping the life insurance coverage in force. Universal life insurance coverage normally ensures a rate as much as a specific age, such as 100 or 105. If you live past that age, you can still keep the policy in force but will have to pay a considerable rate boost.

If you need life insurance, it's finest to keep the policy payments up to date. If you have to buy a new policy later on you'l be charged at your older age and might have to take a new life insurance medical examination. Cash worth is really suggested to be utilized during your life. As soon as you pass away, any money value normally reverts back to the life insurance business. Your beneficiaries get the survivor benefit, which is the face worth of the policy minus any unsettled policy loans and withdrawals. That stated, some universal life policies have the option to offer face worth plus cash worth to beneficiaries when you pass away.

">http://Make certain you understand the policy's rules for taking out cash value and all of the monetary ramifications that feature that decision. You might make a tax-free withdrawal from your policy. Nevertheless, if you withdraw more cash worth than the portion moneyed by your premium payments, the investment gains you take are taxed as income. Also, getting money value will minimize your survivor benefit and your recipients will get less. Typically you can borrow tax-free from the money value of your policy. If you die before the loan and interest are paid back, the outstanding balance will be deducted from your Go here survivor benefit.

You'll receive the cash value minus any surrender charge. Numerous sellers of universal life insurance usage "full underwriting," meaning they take some time to completely analyze your application, validate information, and need that you do a life insurance coverage medical exam. The medical examination typically includes height, weight, blood pressure, and blood and urine samples. It's typically done by a paramedical professional hired by the insurance coverage business, and can be done in your home. There's timeshare foreclosure laws a wide array of data about you available to insurance companies, who can utilize it in prices policies. How much is car insurance. This consists of data on customer credit, your prescription drug history, your answers on past private health and life applications, and your automobile record.

If you desire life insurance protection that lasts the period of your life, you may think about a universal life insurance coverage policy. For instance, universal life insurance can money a trust to look after a special needs child or other dependents after you're gone. You may also think about a universal life insurance policy if you have big long-term savings objectives and require both a financial investment https://rafaelhvdv876.mozello.com/blog/params/post/3306424/how-much-does-homeowners-insurance-cost-things-to-know-before-you-get-this car and life insurance coverage, but just after you've made the most of other cost savings options such as retirement strategies. See our rankings to find the best life insurance companies. Universal life isn't the ideal option for everybody's scenario.

Like universal life insurance coverage, whole life insurance coverage offers you coverage throughout of your life. It also consists of a cash worth part. The biggest distinction between entire life insurance coverage and universal life insurance coverage is the cost: Entire life insurance coverage is usually the most pricey method to buy permanent life insurance coverage since of the warranties within the policy: premiums are guaranteed not to change, the survivor benefit is ensured and money value has a minimum surefire rate of return - How much does health insurance cost. Also, indexed and variable universal life can provide you versatility with payments and the death benefit quantity after you buy the policy.

Entire life insurance coverage is suitable for somebody who likes predictability and wants to spend for it. In addition, lots of entire life insurance coverage policies pay dividends. These are like annual bonus offers paid by mutual insurance companies to consumers, although not ensured. You can utilize dividends to pay premiums, add it to your cash value or merely take the money. Term life insurance coverage is usually readily available for 5, 10, 15, 20, 25 or thirty years. It does not have a cash worth component and you could outlast the policy. But it's the cheapest wesley dale morgan way to buy life insurance coverage. For instance, you might purchase a 20-year policy to cover kids's growing years and college time.

About How Much Is Dental Insurance

If you outlive the term life policy it ends. There's no money worth to take away. That's why it's excellent to match your term life policy as best you can to the length of time you'll require protection. Compare Policies With 8 Leading Insurers The essential difference between whole life insurance and universal life insurance coverage is that universal life insurance can have more versatility. You can frequently vary your premium payments and death benefit with universal life. Entire life insurance coverage has set superior payments. However both kinds of policies have cash worth, and you can add riders to either one.

But prior to you take the cash value and run, make sure you will not require life insurance coverage in the future. Life's circumstances can change, and you don't want to regret cashing out a policy. If you require money now, consider taking a loan versus the policy instead of cashing it out. That gives you alternatives in the future, including keeping the life insurance coverage in force. Universal life insurance coverage normally ensures a rate as much as a specific age, such as 100 or 105. If you live past that age, you can still keep the policy in force but will have to pay a considerable rate boost.

If you need life insurance, it's finest to keep the policy payments up to date. If you have to buy a new policy later on you'l be charged at your older age and might have to take a new life insurance medical examination. Cash worth is really suggested to be utilized during your life. As soon as you pass away, any money value normally reverts back to the life insurance business. Your beneficiaries get the survivor benefit, which is the face worth of the policy minus any unsettled policy loans and withdrawals. That stated, some universal life policies have the option to offer face worth plus cash worth to beneficiaries when you pass away.

when you renew the policy or purchase from a brand-new company. "Think of cars and truck insurance coverage as paying for your security from danger," Gibson says. She includes that while dropping car insurance coverage can offer short-term gains, it could have long-lasting repercussions.

Getting The How Much Is Insurance To Work

Owning a vehicle comes with its fair share of expenditures such as gas, repairs, oil changes, and registration charges. Then there's auto insurance coverage, which can have numerous costs depending on your driving record, type of cars and truck, and other aspects. If you're unsatisfied with your existing vehicle insurance coverage rate, here are eight manner ins which can help decrease your expenses. Whenever you go to your favorite grocery store, you'll usually get a better deal purchasing several loaves of bread instead of just one - What is ppo insurance. The exact same reasoning uses to vehicle insurance coverage. Usually, you'll wind up with a greater quote to insure a single vehicle rather than guaranteeing numerous cars and/or drivers.

Generally, several motorists need to reside in the exact same family and be related by blood or marriage. If you have a teen motorist, you can anticipate your insurance rate to increase given that teenagers are a greater liability behind the wheel. Nevertheless, you could get a excellent trainee discount rate if your child performs well at school and has no acnes on their driving record. Obviously, you'll require to reveal proof to your insurance agent to take advantage of this discount rate. It appears like an apparent suggestion, however it's one that deserves discussing time and time again. Whether you enter a minor car accident or severe cars and truck wreck, accidents have a direct effect on your cars and truck insurance coverage rate.